For any product manager, the line between a successful product and one that completely misses the mark is often drawn by market research. It’s not just about collecting data; it’s the strategic process of gathering real-world information about your target audience to validate ideas, steer development, and ultimately, confirm you’re solving a problem people actually have. This data-first mindset is the most reliable way to turn a hunch into a winning product strategy.

Why Market Research Is Your Most Important Strategic Asset

In a world where new products launch every day, just guessing is a surefire way to fail. Solid market research becomes your North Star, giving you the hard evidence needed to make confident, strategic moves. It’s not a one-and-done task you check off a list; it's a continuous loop that feeds insights into the entire product lifecycle, from the first spark of an idea to launch and all the iterations that follow.

This disciplined approach helps product managers, indie hackers, and solopreneurs shift their thinking from "I think users want this" to "I know they need this." By anchoring your vision in real data, you drastically cut the risk of building something that nobody will pay for.

Building on a Foundation of Evidence

Think of it this way: market research is the foundation you pour before building your house. A weak, cracked foundation means the whole structure is compromised, no matter how beautiful the design is. For a product manager, this means that even the most talented engineers or clever marketing campaigns can't salvage a product that doesn't address a genuine user pain point.

When done right, research helps you:

- Confirm Problem-Solution Fit: Make sure the problem you're tackling is both painful and widespread before a single line of code gets written.

- Mitigate Risk: Avoid wasting precious time and money by spotting potential dead ends and market gaps early on.

- Align Your Stakeholders: Get buy-in from your team, leadership, and investors using concrete data, not just your gut feelings.

- Sharpen Your Strategy: Clearly define what makes your product different and understand how to position it effectively against the competition.

From Afterthought to Global Priority

The immense value of these insights is no secret. Companies everywhere are pouring resources into understanding their customers and the market landscape. The global market research industry is a clear indicator of this trend, having nearly doubled in size from $71.5 billion in 2016 to an estimated $140 billion in 2024. This massive growth highlights a fundamental shift in business: data-driven decisions are no longer optional—they’re the standard. You can find more statistics on the market research industry's growth online.

A product without market research is like a ship without a rudder—drifting at the mercy of the currents. It’s the data that provides direction, helping you navigate through the noise and stay on course toward a successful launch.

This level of investment isn't just for huge corporations anymore. For an indie hacker or a PM at a lean startup, modern tools have made powerful research more accessible than ever. Instead of hiring expensive firms, you can uncover real user pain points just by analyzing unfiltered conversations happening in online communities.

This is exactly where a tool like ProblemSifter comes in. It pinpoints genuine problems being discussed on Reddit and puts you in direct contact with the users who are expressing them.

For a one-time cost—$49 for lifetime access to one subreddit or $99 for three—you get a direct pipeline to validated ideas. Unlike other tools that just spit out generic suggestions, ProblemSifter connects you to the exact Reddit users asking for a solution, creating an instant outreach list. It’s an incredibly efficient way to both discover and promote your product, turning research into your most powerful asset.

Finding Actionable Problems Before Building Solutions

Great products aren't born from clever solutions; they grow from painful, well-understood problems. For product managers, especially in the early going, effective market research isn't about chasing broad trends. It's about finding a specific, nagging issue that a defined group of people is desperate to solve. This is the heart of problem-solution fit.

So many founders and PMs fall in love with their own ideas. They get attached to a feature or a concept without ever confirming if a real audience actually feels the pain they're trying to fix. The goal is to get out of your own head and move from assumptions to solid evidence. You need to discover where your potential customers are already talking about their frustrations, unfiltered and in their own words.

Mining Communities for Unfiltered Insights

Sure, traditional methods like surveys and focus groups have their place. But let's be honest, they can feel a bit sterile. People often tell you what they think you want to hear, or they struggle to articulate their deepest needs in a structured setting. This is precisely why online communities are a goldmine for any product team, especially lean ones.

Platforms like Reddit, niche forums, and even Facebook groups are where people go to vent, ask for help, and share their clunky workarounds. These conversations offer a direct, unprompted window into the user's world. For instance, you might stumble upon a post in a subreddit like r/SaaS that says, "I'm so tired of juggling five different tools just to manage customer feedback. Does anyone have a single tool that does X, Y, and Z?"

That’s not just a random comment. It’s a product spec handed to you on a silver platter. This kind of raw, organic feedback is invaluable because it isn’t tainted by your leading questions. It's the market speaking for itself.

Go Beyond Ideas and Find the People Behind Them

The real challenge, of course, is the sheer volume of noise. Manually sifting through communities can feel like panning for gold in a river of mud—it can take days of scrolling just to find a few promising nuggets. This is where specialized tools can give you a massive edge by automating the discovery process so you can focus on what you do best: building.

This is exactly the gap ProblemSifter was built to fill. It’s designed for makers who need to find validated business ideas without wasting weeks on manual research. The tool analyzes conversations in targeted subreddits to surface recurring problems people are actively trying to solve.

Here’s a quick look at how it turns Reddit noise into a clear, actionable signal.

As you can see, ProblemSifter doesn't just toss a vague idea your way. It provides the specific problem, the context of the original discussion, and a direct link to the post itself.

The real magic here is that it connects you directly to the people experiencing the pain. Unlike other idea-generation tools, ProblemSifter doesn't just suggest concepts—it points you to the exact Reddit users asking for a solution. This is a game-changer for two key reasons:

- Instant Validation: You're not just getting an idea; you're getting proof that real people want it solved. The deeper you dig, the more you can learn about how to approach your own business idea validation with genuine confidence.

- Built-in Outreach List: You immediately have a list of potential early adopters. You can jump into the original thread or reach out directly to ask follow-up questions, share your early prototype, and land your first few users.

For an early-stage founder, this is the ultimate shortcut. Instead of shouting into the void, you're entering a conversation that's already happening, armed with a relevant solution.

This approach transforms market research from a passive, analytical exercise into an active, engagement-driven process. For a one-time payment of $49, you get lifetime access to a curated list of real startup problems from a subreddit of your choice, or you can get three for $99. With no subscriptions or hidden fees, it’s a powerful, cost-effective way for indie hackers and PMs to start building with the confidence that they're solving a real-world problem from day one.

Building Your Modern Market Research Toolkit

Assembling the right tools for market research feels a lot like packing for a long expedition. You wouldn't just throw random gear in a bag; you'd carefully select what you need to make the journey smoother and more successful. Your toolkit as a product manager should be just as intentional—a curated stack of methods and platforms that directly support your goals, whether you're exploring a brand new idea or fine-tuning an existing feature.

The whole game really boils down to two types of insight: quantitative and qualitative. Quantitative research gives you the what. Think A/B tests or large-scale surveys that deliver hard numbers on what users are doing. On the flip side, qualitative research gives you the why—the rich, contextual insights from user interviews or community discussions that explain the motivations behind those numbers. A truly effective product manager knows how to blend both.

Curating Your Research Stack

If you're an early-stage founder, a solopreneur, or an indie hacker, your focus has to be on lean, high-impact tools. You don't need a six-figure budget to get powerful insights. The trick is to choose platforms that give you the most direct path to understanding your potential customers without getting bogged down in hefty recurring fees. Your stack should cover the entire journey, from initial ideation to ongoing user feedback analysis.

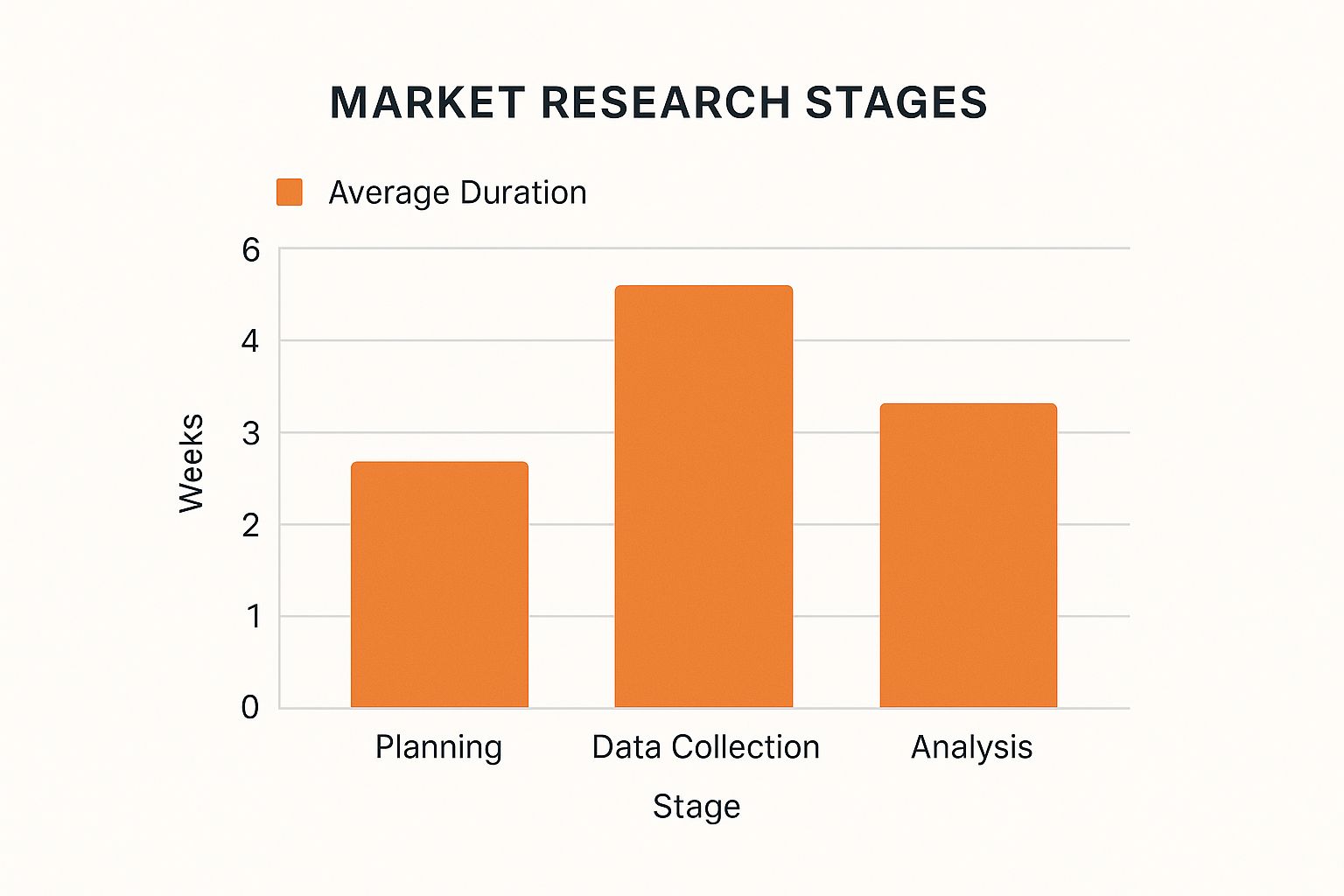

This is where efficiency becomes critical. Market research can be a long haul if you're not careful.

As you can see, data collection is often the biggest time sink in the whole process. This chart really drives home why finding tools that speed up this phase is a massive strategic advantage. It means getting to those "aha!" moments faster.

Essential Tools for Product Managers

Great products aren't built on guesses; they're built on clear signals from the market. Let's walk through some of my go-to tools that can help you find that signal at every stage, from discovering problems to validating your solutions.

A Product Manager's Guide to Market Research Tools

Choosing the right tool for the job is half the battle. This table breaks down a few key players to help you decide what fits your needs based on function, cost, and what makes them stand out.

| Tool | Primary Use Case | Pricing Model | Key Feature |

|---|---|---|---|

| ProblemSifter | Ideation & Problem Discovery | One-time fee | Scans Reddit for validated user problems, connecting you to potential first customers. |

| Typeform | Quantitative Surveys & Feedback | Freemium / Subscription | Creates beautiful, conversational forms that boost response rates. |

| UserTesting | Qualitative Usability Testing | Subscription | Provides video feedback from real people interacting with your product or prototype. |

| Maze | Prototype Testing & User Research | Freemium / Subscription | Integrates with design tools (Figma, Sketch) for rapid, unmoderated testing. |

Ultimately, the best stack is the one that aligns with your project's specific stage and budget. A mix of these tools can give you a comprehensive view without requiring a massive initial investment.

A Deeper Dive Into the Toolkit

For Finding Real User Pain Points (Ideation) This is where so many founders stumble. Instead of brainstorming in a vacuum, you need to find where people are already talking about their problems. Reddit is an absolute goldmine, but sifting through it manually is a nightmare. This is the exact pain point ProblemSifter was built to solve. It’s a lifesaver for indie hackers and solopreneurs who need to find validated problems without spending weeks on manual research. It scans targeted subreddits and surfaces raw, unfiltered user complaints.

For Surveys and Feedback Collection (Quantitative) Once you have a hypothesis, you need to validate it at scale. Tools like Typeform or SurveyMonkey are fantastic for this. Their free tiers are often more than enough for early-stage teams to run quick validation surveys or gather that first round of user feedback after launching.

For User Interviews and Usability Testing (Qualitative) When you need to dig deeper, nothing beats watching someone use your product. Platforms like UserTesting or Maze let you get direct feedback on prototypes and live sites. You can literally see where users get stuck, uncovering friction points that a simple survey would never catch.

Unlike other tools, ProblemSifter doesn’t just suggest ideas—it connects you to the exact Reddit users asking for them. This provides not only a validated problem but also an immediate list of potential customers to contact for deeper interviews or beta testing.

The key is to be strategic. Many research platforms are built on expensive subscription models, which can quickly drain the resources of a lean startup. This is where a different approach to pricing can be a game-changer.

For example, ProblemSifter offers lifetime access for a one-time payment. For just $49, you get a perpetually updated list of real startup problems from one subreddit, or you can expand to three for $99. There are no recurring subscriptions or hidden costs. This is a huge advantage for budget-conscious founders, giving them a powerful, long-term asset for continuous ideation.

By combining a discovery engine like ProblemSifter with free or low-cost tools for surveys and interviews, any product manager can build an incredibly effective market research toolkit. This setup empowers you to stay close to your users, validate your ideas with real-world data, and ultimately build products that solve very real, very painful problems.

From Raw Data to Strategic Insights

So, you've done the legwork. You’ve gathered stacks of interview transcripts, survey results, and forum comments. But that's just the beginning. The real magic happens when you turn that mountain of raw data into a coherent strategy that actually moves the needle.

This is the part of the job that separates good product managers from great ones. It’s about stepping back from the individual data points to see the bigger picture—the hidden patterns and themes that connect everything. Without this synthesis, all you have is a pile of interesting but disconnected facts, not a roadmap.

The Art of Pattern Recognition

Your first move is to bring some order to the chaos of your qualitative data. Think of it as sorting through a massive junk drawer. The goal is to group similar items together so you can see what you actually have. In research, this is often called thematic analysis.

Start by tagging individual comments or feedback with descriptive keywords. For instance, if you see multiple users complaining about the initial setup process, you might create a "difficult onboarding" tag or cluster. As you work through your notes, you'll see which clusters start to swell. Those are your hot spots.

Suddenly, you're not just dealing with anecdotes. You can put numbers to the problems. You can confidently state, "35% of our interviewees mentioned poor navigation," which carries a lot more weight than a vague "some people were confused." To really nail this process, check out our guide on the best practices for conducting market research.

Building Data-Backed Personas and Journeys

With your feedback neatly clustered, you can start building artifacts that make the data tangible for your entire team. User personas and journey maps aren't just pretty documents; they are powerful tools for building empathy and keeping everyone focused on the same user and the same problems.

- Data-Driven User Personas: Forget about making up a fictional character. Build your personas directly from your research. Use the clustered feedback to define their goals, motivations, and, most critically, their pain points. A persona grounded in real data ensures your team is solving real problems.

- User Journey Maps: Chart the specific steps a user takes to achieve a goal with your product. Use your research to pinpoint every moment of friction or delight. This visual map makes it painfully obvious where the biggest opportunities for improvement lie.

The ultimate goal of synthesis is to create a single source of truth. When an engineer or a stakeholder asks, "Why are we building this?" you can point directly to the clustered feedback, the persona it impacts, and the exact step in their journey you're fixing.

The Role of AI in Modern Analysis

Let's be honest: manually sifting through thousands of app reviews or support tickets is a soul-crushing task, not to mention it's rife with potential bias. This is where modern tools can give you a serious edge.

AI-powered platforms have completely changed the game. They use natural language processing (NLP) to tear through massive volumes of qualitative feedback in minutes, not weeks. These tools can automatically perform sentiment analysis, identify emerging topics, and spot trends long before a human analyst ever could.

This allows product managers to get a real-time pulse on user sentiment at scale, leading to faster, more confident decisions. To see just how much this is shaking things up, you can read about how AI is impacting market research and creating new standards.

This shift means even small teams or solo founders can now access the kind of deep insights that were once the exclusive domain of large corporations. It turns a resource-heavy chore into a continuous, automated flow of discovery.

Embedding Research into Your Product Roadmap

So, your market research is done. You’ve sifted through the noise, clustered the insights, and the patterns are finally clear. Now for the hard part: turning all that work into action.

Without a direct line from data to development, even the most profound insights risk becoming interesting trivia in a forgotten report. Your job now is to translate what you've learned into a language that resonates with everyone—from the engineers building the features to the executives funding them.

This means moving beyond raw data. You need to build a compelling, evidence-backed narrative that justifies the direction you're proposing for the product.

From Insights to Actionable Priorities

A slide deck filled with user quotes and survey charts isn't going to cut it. You have to connect those findings directly to business objectives and product priorities. This is where a solid prioritization framework becomes your best friend.

Frameworks help you swap subjective opinions for objective, data-driven decisions. They provide a structured way to evaluate what to build next, ensuring your roadmap is built on a foundation of evidence, not just gut feelings.

A model I've found particularly effective is the RICE scoring framework. It’s a straightforward way to evaluate potential initiatives across four key factors:

- Reach: How many people will this feature actually impact over a set period?

- Impact: How much will this move the needle on our core goals, like conversion or retention? (This can be a scale, e.g., 3 for massive impact, 0.25 for minimal).

- Confidence: How certain are we about our estimates for reach and impact? This is where your research provides the proof.

- Effort: What’s the real cost in time from product, design, and engineering?

By calculating a simple score (Reach x Impact x Confidence / Effort), you get a ranked list that makes prioritization debates far more productive and less political. You can explore this further in our detailed guide on market research for startups.

Presenting Your Case to Stakeholders

With your priorities scored and ranked, it’s time to build consensus. Remember, different stakeholders care about different things, so you'll need to tailor your message.

- For Engineering: They need the "what" and the "why." Clearly define the problem you’re solving with user stories and pain points pulled straight from your research. This context helps them build better, more empathetic solutions.

- For Leadership: They're focused on business outcomes. Frame your proposals around metrics like increased revenue, gaining market share, or neutralizing a competitor. Your RICE scores are perfect for showing a thoughtful, strategic approach to resource allocation.

The most persuasive product managers don't just share data; they tell a story. They weave together user pain points, market opportunities, and strategic goals into a narrative that makes their proposed roadmap feel not just logical, but inevitable.

Looking Ahead: The Rise of Synthetic Data

The field of market research is always evolving, and one of the biggest shifts on the horizon is the emergence of synthetic data. As we move through 2025, this technology is gaining serious traction as a way to tackle persistent challenges like data privacy, survey fatigue, and declining data quality from real respondents.

Synthetic data uses artificially generated datasets to accurately mimic real consumer behavior. For product managers, this opens up a whole new world. It allows you to model complex scenarios and test hypotheses without collecting personally identifiable information or running costly surveys that fewer people want to answer anyway.

As this becomes more mainstream, you can discover more about the trends shaping market research in 2025 to stay prepared. Understanding how to work with these new data models will give you a sharp competitive edge and ensure your research practices remain both effective and future-proof.

Answering the Tough Questions About Market Research

Even with the best plan in hand, you'll always hit practical hurdles and nagging questions when you start digging in. I've seen it time and again. Let's tackle some of the most common ones that product managers, indie hackers, and solopreneurs wrestle with. The goal here is to give you clear, no-fluff answers so you can move forward with confidence.

How Much Should I Actually Budget for Market Research at a Startup?

When you're at an early-stage startup, every dollar counts. Your research budget should be lean, and your methods have to be scrappy. Forget about expensive enterprise tools for now. Your focus should be on high-impact, low-cost tactics that deliver the most insight for your time and money.

Think one-on-one user interviews (your time is the main cost), deep dives into competitor reviews, and lurking in online forums where your potential customers hang out.

Instead of getting locked into pricey monthly subscriptions, prioritize platforms that offer lifetime value. For example, a tool like ProblemSifter gives you permanent access to validated problems sourced directly from Reddit for a small one-time fee. This provides an incredible ROI compared to recurring costs, freeing up your budget for other critical areas while still giving you a direct line to user pain points.

For just $49, you can get lifetime access to a curated list of real problems people are discussing in a subreddit of your choice. It completely flips the traditional cost model, turning research into a long-term asset, not a monthly expense.

What’s the Real Difference Between Market and User Research?

This is a classic. Think of it as the "what" versus the "why." They are two sides of the same coin, and as a product manager, you need to be fluent in both to build something that people will actually buy and use.

Market Research: This is your 30,000-foot view. It’s about the big picture—competitors, industry trends, and the overall market size. It answers the fundamental business question: Is there a viable opportunity here?

User Research: This zooms all the way in to the individual. It’s about understanding a specific person's behaviors, needs, motivations, and frustrations. It answers the most critical product question: Who are we building this for, and why will they care?

Essentially, market research tells you if there's a hungry crowd. User research tells you what meal to cook for them. You need both.

How Do I Do This Without a Dedicated Research Team?

Welcome to the club. Many product managers, especially indie hackers and those at smaller companies, are a "research team of one." The secret is to be agile, resourceful, and relentlessly focused. Don't try to boil the ocean.

Start with a single, clear question you absolutely need to answer to de-risk your next big decision. Your goal isn't to write a perfect academic paper; it's to get just enough information to move forward with less guesswork.

Unlike other tools, ProblemSifter doesn’t just suggest ideas—it connects you to the exact Reddit users asking for them. This gives you a direct line for targeted outreach, turning research into a promotion tool from day one.

This is where the right tools become an extension of your brain. Lean on free and low-cost platforms. Use Google Trends to gauge interest, Typeform's free tier for quick surveys, and online communities for those raw, qualitative insights.

A tool like ProblemSifter is a game-changer for a solo operator. It automates the soul-crushing work of manually sifting through Reddit for pain points, saving you countless hours. It doesn't just give you an idea; it gives you the original post and the usernames of people expressing that exact need. Suddenly, you have a pipeline for both validation and your first marketing outreach.

By focusing your efforts and using smart tools, you absolutely can gather enough data to make your next move a smart one—no team required.

Ready to stop guessing and start building what people are already asking for? ProblemSifter turns Reddit into your personal idea engine, delivering validated problems and a ready-made list of your first potential customers.