Learning how to do market research for your startup really boils down to one simple, non-negotiable principle: stop guessing and start validating. It’s a methodical way of digging into your target audience, checking out the competition, and understanding the market you're about to enter. The goal is to make absolutely sure you’re building something people genuinely need and, just as importantly, are willing to pay for. It’s about getting beyond your own excitement for an idea to find real, quantifiable demand.

Why Market Research Is Your Startup's Bedrock

I've seen it happen time and time again: a founder falls head-over-heels for their solution before they even have a casual acquaintance with the problem. They'll burn through months, sometimes even years, crafting a product based on a personal hunch, only to launch to a deafening silence. This isn't just a string of bad luck—it's the completely predictable result of skipping the most critical phase of building a company.

Market research isn't some stuffy, academic chore meant for massive corporations with deep pockets. If you're an indie hacker or a solopreneur, it's your most powerful survival tool. This is the foundational work that will steer every single decision you make down the line, from your product features and pricing to how you talk about your brand.

The Heavy Price of Assumption

Building a startup without research is like trying to solve a maze with a blindfold on. Sure, you might stumble your way to the exit eventually, but you'll waste an incredible amount of time, energy, and money hitting dead ends first. The data tells a pretty grim story about what happens when founders choose to fly blind.

One of the biggest reasons new businesses don't make it is a direct consequence of skipping this step. In fact, a sobering 34% of small businesses collapse because they never achieve product-market fit. That’s just a business-school way of saying they built something nobody actually needed. You can dig into more data on why startups don't make it to see just how common this pitfall is.

The point of early-stage research isn't to get a pat on the back for your brilliant idea. The point is to uncover the truth, even if that truth means you need to pivot or scrap the whole thing and start over. It's about taking risk off the table before you sink your most precious resources—your time and your money—into a losing bet.

From "What to Build" to "What to Solve"

Good market research forces a vital shift in your thinking. It pulls your focus away from the cool features you want to build and pushes it toward the painful problems your audience needs to solve. This problem-first mindset is what separates founders who succeed from those who just build interesting side projects.

Let me break it down with an example:

- Without Research: You get an idea for a "smart to-do list with AI." You spend six months perfecting the algorithm, only to discover that people are perfectly fine with their simple, non-AI notepads.

- With Research: You start by exploring why people get frustrated with productivity apps. You find that a specific niche, like freelance writers, really struggles to track tasks and deadlines across multiple client projects. Suddenly, your "smart to-do list" has a real purpose and a paying audience.

This is the core of how to do market research for a startup. It gives you the evidence you need to build with intention. It transforms your venture from a high-stakes gamble into a smart, calculated effort to deliver real value to a specific group of people who are already out there, looking for a better solution.

Uncovering Real Problems on Reddit

The best startup ideas aren't dreamed up in a sterile brainstorming session. They’re found out in the wild, where real people are dealing with real frustrations. While traditional market research has its place, the most powerful insights for indie hackers and solopreneurs often come from the raw, unfiltered conversations happening on Reddit.

This is exactly why Reddit is such a powerful tool for founders. Forget polished corporate-speak; Reddit is a massive collection of niche communities where people openly complain, share clunky workarounds, and ask for help. It’s a goldmine of genuine user pain points, and it’s all happening organically.

Why Reddit Is a Goldmine for Indie Hackers

As an indie hacker or solopreneur, your time is your most valuable asset. Manually digging through hundreds of subreddits, posts, and comment threads to spot a pattern is a massive time sink. It’s tedious, and it’s incredibly easy to miss the subtle clues hidden in all that noise.

This is where specialized tools come in. They automate the discovery process, saving you weeks of manual grunt work and pointing you directly to the real, unfiltered problems people are talking about right now.

One of the best tools built specifically for this purpose is ProblemSifter. It was designed from the ground up for founders who want to tap into Reddit’s potential without the manual grind. The tool scans specific subreddits, like r/SaaS or r/indiehackers, and intelligently clusters recurring problems that users are posting about.

Unlike other tools, ProblemSifter doesn’t just suggest ideas—it connects you to the exact Reddit users asking for them. It provides not just the idea, but the original post and the Reddit usernames expressing the pain point.

This direct connection is the game-changer. You're not just getting a vague concept; you're getting a pre-validated problem with a built-in list of your first potential customers. If you want to go deeper on this tactic, our guide on using Reddit for effective market research is a great next step.

From Problem Discovery to Targeted Outreach

The real beauty of using a tool like ProblemSifter is that it serves two purposes: it’s a launchpad for your idea and a channel for your first users. Once you’ve pinpointed a painful, recurring problem, your next steps become crystal clear.

- Quick Validation: You can instantly see how many people are hitting the same wall and what half-baked solutions they’re already trying. This is how you validate demand before you even think about writing code.

- Laser-Focused Outreach: The usernames you find become your initial outreach list. You can message them directly to run customer interviews, dig deeper into their pain points, and get feedback on your proposed solution.

- Built-in Launch Promotion: When your MVP is ready, you can circle back to the exact threads where the problem was first discussed and share what you’ve built. This helps you both ideate and promote your solution with targeted outreach.

This isn’t just research; it’s a complete loop from problem discovery straight through to customer acquisition. It’s a lean, efficient, and incredibly effective playbook for builders.

A Cost-Effective Approach to Validation

Let's be honest: for most early-stage makers, budget is a major constraint. Many market research platforms come with eye-watering monthly subscriptions that are completely out of reach.

This is another reason a focused tool like ProblemSifter is so valuable. It has a simple, competitive pricing model with no subscriptions and no hidden fees. For just $49, you can get lifetime access to a curated list of real startup problems people are discussing in one subreddit. The price is $99 for lifetime access to three subreddits.

This one-time payment model makes it a smart, accessible alternative to expensive enterprise software, freeing up your cash to actually build the product.

Mapping Your Competitors and Market Gaps

Alright, you've zeroed in on a real, painful problem people are having. The temptation now is to dive headfirst into building the solution. I get it. But hitting pause right now to size up the competition is one of the smartest moves you can make.

Don't think of this as just listing rivals. This is a strategic intelligence mission. The goal isn't to get discouraged by what's already out there. It’s to find the cracks in their armor—the customers they're ignoring, the clunky user experiences they haven't fixed, and the gaps in the market they’ve completely overlooked.

Identifying Who You’re Really Up Against

First things first, you need a clear map of the battlefield. It’s easy to get tunnel vision and only focus on the most obvious players, but your true competitors often come in different shapes and sizes.

Direct Competitors: These are the companies you’d name off the top of your head. They offer a very similar solution to the same crowd you’re targeting. For a new apartment booking app, this would be giants like Airbnb or Booking.com. Same problem, same people.

Indirect Competitors: These businesses solve the same core problem but in a totally different way. For that booking app, this might be traditional travel agencies or even long-term rental services. They’re meeting the need for accommodation, just not with a similar product.

Replacement Competitors: This is the category everyone forgets, but it’s often your biggest threat. These are the scrappy workarounds people use instead of a dedicated product. It could be a ridiculously complex spreadsheet, a few different apps duct-taped together, or even the decision to just live with the problem.

Your true competition might not be another slick app. It might just be that "good enough" spreadsheet your ideal customer has been wrestling with for years. Knowing this helps you nail your messaging later on.

Deconstructing Their Strategy and Product

Once you have a solid list of 5-10 competitors across these types, it's time to put on your detective hat. The objective here is to dissect their entire business to see what works, what doesn’t, and where you can slip in. I find a simple spreadsheet is perfect for tracking all this.

Here’s what I always look for:

- Product & Features: Get your hands on the product. Sign up for a free trial or even pay for one month. What are the core features? What's the onboarding like? Where does it feel clunky or just plain confusing?

- Pricing & Business Model: How do they make money? Is it per user, per feature, or based on usage? Are they pushing a one-time fee or a recurring subscription? This tells you a lot about their priorities.

- Marketing & Positioning: Read their website's homepage carefully. How do they talk about themselves? What's their main promise to customers? Tools like Ahrefs or Semrush can even show you the keywords they're targeting.

Pro Tip: Customer reviews are a goldmine of unfiltered intelligence. Go scour G2, Capterra, and Reddit threads about your competitors. When you see users complaining about the same missing feature or frustrating workflow over and over, that’s not a complaint—it's a feature roadmap handed to you on a silver platter.

Finding Your Unfair Advantage

After this deep dive, the fog will start to clear. You'll see the market in a new light—who the big dogs are, what customers actually think of them, and how they get people in the door. This knowledge is your ammunition.

This whole process is about finding a viable entry point. The US alone has more than 33.3 million small businesses, with nearly half starting from home. That’s a staggering number of potential niches waiting for a tailored solution. You can dig into more numbers in this breakdown of startup statistics.

Now, you can finally answer the most critical question of all: "What is our unique value proposition?"

Based on your research, you can build a strategy around a specific angle. Maybe you'll win by:

- Targeting an Underserved Niche: Your competitor might serve the entire market, but you can build a far better product for a specific slice of it, like freelance illustrators or early-stage B2B SaaS founders.

- Offering a Simpler, More Focused Solution: If the competition is a bloated, feature-heavy beast, you can win with an elegant tool that does one thing perfectly.

- Disrupting on Price or Model: Being "cheaper" is a tough game, but a radically simpler pricing model (like a flat fee versus a confusing subscription) can be a massive differentiator.

- Providing a Superior User Experience: Often, existing tools are powerful but are a complete nightmare to use. A beautiful, intuitive design can become your most defensible advantage.

This analysis isn't just an academic exercise. It transforms your idea into a sharp, strategic plan of attack, ensuring you don't just enter the market—you enter it with a clear reason to win.

Talk to Humans: How to Validate Your Solution with Customer Interviews

You've sifted through the data and mapped the competitive terrain. Fantastic. But now it’s time for what I consider the most critical—and human—part of the whole process: actually talking to people. This is where you step away from the spreadsheets and get face-to-face (even if it's virtual) to see if your proposed solution holds up in the real world.

The objective here is simple but often misunderstood. You aren't trying to sell your idea or fish for compliments. You're on a learning mission. Your goal is to deeply understand your potential customers' current habits, their underlying motivations, and the genuine frustration the problem causes them. This is the only way to know if your solution actually fits their life.

Finding the Right People to Interview

Let’s be clear: the quality of your feedback is a direct reflection of who you talk to. If you interview random people, you’ll get random, useless feedback. You absolutely must speak with people who are actively grappling with the problem you've identified.

This is where your earlier research really starts to pay dividends. If you used a tool like ProblemSifter, you're already way ahead. It doesn't just surface problems; it points you directly to the Reddit users who are complaining about them. That’s a pre-vetted list of ideal interview candidates right there.

A focused recruitment strategy is non-negotiable.

- Go Direct: Use the Reddit usernames you found on ProblemSifter for some seriously targeted outreach. When you message them, reference their original post or comment. It shows you’ve done your homework and aren't just spamming.

- Be Part of the Community: Don't just show up and ask for favors. Actually participate in the niche subreddits or online communities where your audience gathers. Add value first, then ask for 30 minutes of their time.

- Tap Your Network: You'd be surprised who your friends and colleagues know. Ask for introductions to people who fit your target demographic. A warm intro is always better than a cold message.

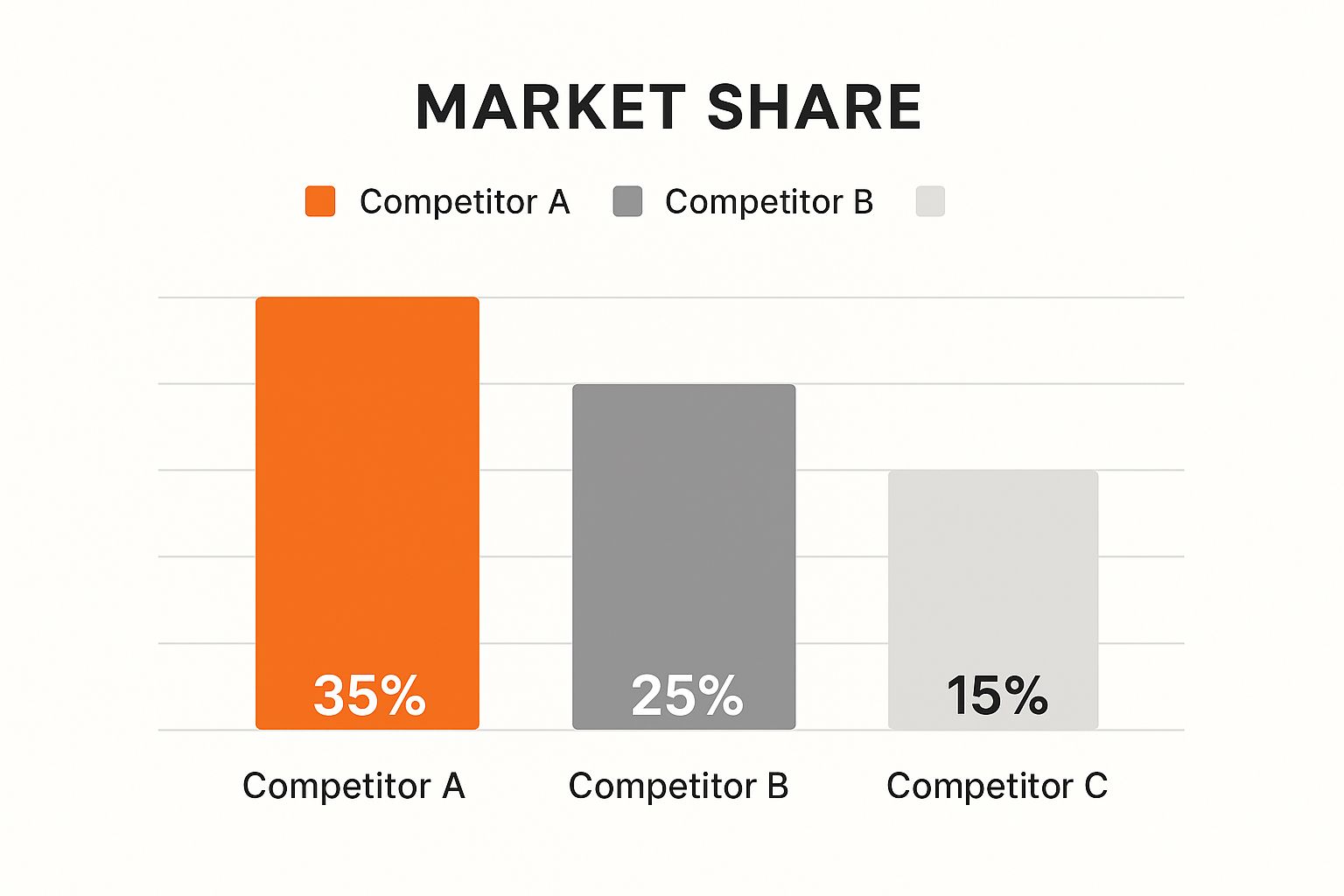

This chart helps visualize the market you're walking into. While a couple of big players might have a large slice of the pie, there's always a significant chunk served by smaller competitors or, even better, left completely unserved. That's your opening.

Asking Questions That Don't Just Get You a "Yes"

So many founders sabotage their own interviews by asking terrible, leading questions. Anything like, "Wouldn't it be amazing if a tool could do X for you?" is a trap. Of course, they'll politely say "yes." That's false validation, and it's worse than no validation at all.

The best approach I've found is outlined in "The Mom Test." The core idea is to ask about their life and past behaviors, not your idea. You want specifics, not daydreams.

Your job is to listen, not talk. Ask open-ended questions that get them telling stories. You want them to describe the problem in their own words, complete with all the raw frustration and messy details.

Instead of, "Would you pay for this feature?" try asking, "How are you dealing with this right now?" or "Walk me through the last time you had to [complete the task]." These questions uncover real behaviors, existing budgets (or lack thereof), and the true pain level of the problem. For a deeper dive into this, check out our guide on how to find your target audience and really get inside their heads.

Choosing between qualitative methods like interviews and quantitative ones like surveys can be tricky. Here’s a quick breakdown to help you decide which approach fits your current needs.

Qualitative vs Quantitative Research Methods

| Aspect | Qualitative Research (Interviews, Focus Groups) | Quantitative Research (Surveys, Analytics) |

|---|---|---|

| Goal | To understand the "why" behind behaviors and opinions. Deeply explore problems and motivations. | To measure and validate. Collect numerical data to identify patterns and trends at scale. |

| Sample Size | Small (5-15 people). Focus is on depth, not breadth. | Large (hundreds or thousands). Focus is on statistical significance. |

| Question Type | Open-ended, exploratory questions (e.g., "Tell me about a time when..."). | Closed-ended questions (e.g., multiple choice, rating scales). |

| Best For | Early-stage problem discovery, understanding context, and testing value propositions. | Validating a hypothesis with a larger audience, measuring market size, A/B testing. |

| Output | Rich, detailed narratives, direct quotes, and user stories. | Charts, graphs, and statistical data. |

Ultimately, you need both. Start with qualitative research to find the right questions to ask, then use quantitative methods to see how widespread those feelings are.

Turning Conversations into a Concrete Plan

After just a handful of good interviews, you'll start hearing the same things over and over. The same workarounds, the same frustrations, the same "I wish I could just..." statements. That's the signal you're looking for. Now, your job is to distill all that raw feedback into a focused plan for your Minimum Viable Product (MVP).

Go through your notes and start grouping things by theme:

- Pain Point Patterns: What specific struggles did at least 3-4 people mention independently?

- The Real Goal: What are they really trying to accomplish? What does a "win" look like for them?

- "Must-Haves" vs. "Nice-to-Haves": Which problems are so annoying that they're already trying to solve them with duct-taped solutions? Those are your must-haves.

These insights are pure gold. They become your product roadmap, stripping away the guesswork. This is how you ensure the first thing you build is something you know your target market desperately wants. This is how you build an MVP that actually matters.

Building Your Go-To-Market Strategy from Data

All that research you've done? It's just a pile of data until you sharpen it into a weapon. The competitor maps, interview notes, and Reddit threads are the raw materials. Now, it's time to translate that intelligence into a concrete go-to-market (GTM) strategy.

This isn't just a marketing plan. A real GTM strategy is the story that connects your product to your audience and carves out your unique spot in the market. It's the final, and most critical, step in turning your hard-earned research into actual revenue.

Synthesizing Insights into a Cohesive Plan

Start by pulling all the threads of your research together. Where do they overlap? The real magic happens when you spot the patterns.

Did the exact pain points you found on Reddit echo the frustrations you heard in your one-on-one interviews? Do the gaps you identified in your competitor analysis line up perfectly with the features your interviewees said they'd happily pay for?

Those points of convergence are gold. They’re your strategic foundation, giving you the confidence to make the tough calls. Once you’ve connected these dots, you can start building the core pillars of your strategy.

Crafting Detailed User Personas

Armed with real data, you can finally move beyond vague demographic sketches and create truly detailed user personas. These aren't just made-up characters; they are living composites of the people you’ve been studying.

Give them names, job titles, and, most importantly, goals and frustrations pulled directly from your research.

- Who are they? Get specific. Don't just say "a project manager." Instead, define "Alex, a project manager at a mid-sized tech company who is constantly struggling to keep cross-functional teams aligned."

- What is their core problem? Use their own words. "I burn hours every single week just chasing down status updates in Slack and email."

- Where do they hang out online? This is your marketing roadmap. Are they active in

r/SaaS, specific LinkedIn groups, or do they follow niche industry newsletters?

These personas become your north star. They’ll guide every product decision and make sure your marketing messages land with a punch.

Sharpening Your Unique Value Proposition

With a crystal-clear picture of your ideal customer and the competitive landscape, you can now write a razor-sharp Unique Value Proposition (UVP). This is your elevator pitch—a concise statement explaining what you do, who you serve, and why you’re the only real choice.

Your UVP is not a catchy slogan. It's the core promise you make to your customers. It must directly tackle the primary pain point you've identified and show how you crush it better than anyone else.

For instance, if your research revealed that competitors are powerful but notoriously complicated, your UVP might be: "The first project management tool built for non-project managers, delivering total clarity without the learning curve."

Outlining Your Initial Launch and Growth Channels

A GTM plan is useless without an actionable launch strategy. How are you going to get your first 10 users? Your first 100? Look back at your research—the answers are already there.

If you discovered your audience lives in a handful of subreddits, that’s where you launch. The list of usernames you pulled using a tool like ProblemSifter? That’s your outreach list for finding your first beta testers. The beauty of this approach is that ProblemSifter doesn't just give you ideas; it points you to the specific Reddit users asking for them, creating a direct line for both validation and targeted promotion. This is a game-changer for finding profitable niches with built-in audiences.

Your research also dictates your pricing. By benchmarking against competitors and truly understanding the perceived value from your interviews, you can set a price that feels like a bargain for the problem you're solving.

This whole process is about ensuring every decision—from your MVP’s feature set to your first marketing dollar—is grounded in real data, not just a gut feeling.

Founder's Market Research FAQ

Even with a solid plan, you're bound to have some nagging questions about the nitty-gritty of market research. I get it. I've been there. This section tackles the most common queries I hear from indie hackers, solopreneurs, and early-stage founders just like you. The goal here is to give you straight, actionable answers so you can move forward with confidence.

How Much Should a Startup Budget for Market Research?

Honestly, for an early-stage founder, your budget can be close to zero in actual cash. Your most valuable asset right now is time.

You have to get scrappy. Forget about shelling out thousands for fancy analyst reports or enterprise-grade software. That’s for the big guys. Your focus should be on high-impact, low-cost activities that get you the answers you need without draining your bank account.

This is where a tool like ProblemSifter becomes a game-changer. Instead of a hefty monthly subscription, a simple, one-time fee of $49 gives you lifetime access to a goldmine of real startup problems people are actively discussing on Reddit. It’s a classic "work smarter, not harder" move.

So, what does your "budget" actually look like?

- Your Time: This is your main investment. Carve out hours to dig through Reddit threads, dissect competitor websites, and read every last customer review on sites like G2 and Capterra.

- Minimal Cash: Your biggest expense might be that one-time fee for ProblemSifter. The rest is about leveraging free tiers of SEO tools and the shoe-leather effort of finding and talking to real people.

In the early days, effective research is fueled by your ingenuity, not your wallet.

What Is the Biggest Mistake Founders Make in Market Research?

Hands down, the single most common and destructive mistake is confirmation bias. We all do it. It’s that natural human pull to find evidence that proves our brilliant idea is, in fact, brilliant. It’s a dangerous trap, and most founders fall into it without even realizing it.

You see it in the way they ask questions. They'll ask leading questions like, "Wouldn't you love a feature that does X?" instead of a genuinely curious, open-ended question like, "Walk me through how you currently handle Y." The first question is just fishing for a 'yes.' It creates a false sense of security and leads you straight down the path of building something nobody actually needs.

The point of research isn’t to be right; it’s to find the truth—even if that truth shatters your original idea. Being wrong early is a gift. It saves you from the colossal pain of being wrong later when the stakes are infinitely higher.

To fight this, you have to adopt a mindset of genuine curiosity. You're a detective, not a salesperson. Starting your entire process with raw, unfiltered problems from a platform like Reddit is a powerful way to sidestep this bias from the get-go. You’re beginning with a validated pain point, not just your own pet theory.

How Do I Know When I've Done Enough Research?

Market research isn't a one-and-done task you check off a list; it’s a continuous loop. But for that initial, pre-build phase? There’s a definite finish line.

You know you've done enough when you can answer these questions instantly, with specifics, and without fumbling for words:

- Who is my customer, really? Not "creatives," but "freelance graphic designers who use Figma daily."

- What is their nagging, recurring problem? Not "they need better organization," but "they struggle to organize and reuse design assets across dozens of client projects."

- How do they solve it now, and why does it suck? For example, "They use a chaotic mess of local folders and screenshots, which kills their efficiency and creates version control nightmares."

- Who are my real competitors, and what’s my unique edge? "Competitor A is powerful but way too complex. My angle is a dead-simple, single-purpose workflow that just works."

- Is there any proof people would actually pay for a better way? "In my interviews, three separate people told me they’d already tried and abandoned paid tools because they were too bloated for their needs."

The magic moment is when you start hearing the same problems, the same workarounds, and the same frustrations over and over again from different people. That’s convergence. It’s a strong signal you’ve hit a real, foundational truth and are ready to build a focused Minimum Viable Product (MVP).

Can I Do Market Research if I Haven't Built Anything Yet?

Yes! In fact, you must. The absolute best time to do market research is before you write a single line of code. This is what separates the successful startups from the expensive hobbies.

Right now, your "product" is just an idea, a set of assumptions, maybe a quick mockup in Figma or a simple slide deck. That's perfect. You're not testing a polished product; you're testing the problem itself and whether your proposed solution even matters. Doing this research upfront will save you an unbelievable amount of time, money, and heartache.

This is exactly where tools built for indie hackers shine. A platform like ProblemSifter doesn’t just spit out vague ideas—it links you directly to the Reddit users who are practically begging for a solution. For someone in the pre-build phase, this is invaluable. It gives you:

- A validated problem worth investigating.

- A ready-made list of potential users to interview for deep, qualitative insights.

- Real community data to gut-check your idea before you commit a single weekend to development.

This approach lets you de-risk your entire venture from day one. You’re ensuring your precious resources are spent solving a problem that the market has already told you exists.

Ready to stop guessing and start solving real problems? ProblemSifter turns Reddit's unfiltered discussions into your personal startup idea engine. Get a direct line to validated pain points and the users experiencing them. Find your next big idea on ProblemSifter.