In the world of startups and indie hacking, success isn't just about having a brilliant idea; it's about solving a real, validated problem. The critical difference between a product that launches successfully and one that fails often lies in understanding the market's pulse before you write a single line of code. This is where market trend analysis tools become indispensable.

These platforms are the modern builder's compass, essential for navigating consumer needs, validating startup concepts, and spotting opportunities before they become mainstream. Effective analysis moves beyond tracking broad search interest; it's about uncovering the specific 'why' behind user behavior, identifying nascent pain points, and finding the communities already discussing potential solutions. Some tools, like ProblemSifter, are specifically built for this, mining platforms like Reddit to find real user pain points and validate startup ideas with community data.

This guide moves beyond generic feature lists to provide an in-depth, analytical review of the top 12 market trend analysis tools. We will dissect each platform, offering practical use cases, honest limitations, and implementation guidance complete with screenshots and direct links. Our goal is to help you select the right tool to transition from guesswork to data-driven growth, ensuring you build what people actually want and need.

1. ProblemSifter

ProblemSifter distinguishes itself among market trend analysis tools by focusing on a powerful, often-overlooked source of raw consumer insight: Reddit. Instead of tracking broad market movements or search volumes, it mines targeted subreddits to uncover specific, unsolved user problems. This unique approach transforms communities like r/SaaS and r/indiehackers into a direct pipeline for validated startup ideas, providing founders with real pain points expressed by engaged, potential customers. For indie hackers and solopreneurs, it's a go-to tool for startup ideation that cuts through the noise.

The platform's core strength lies in its ability to convert unstructured community chatter into actionable intelligence. For early-stage entrepreneurs, this is a game-changer. It shifts the ideation process from guesswork to a data-driven exercise, significantly de-risking the venture by ensuring there's a genuine need for the solution being built.

Key Features & Use Cases

Unlike other market trend analysis tools that provide high-level data, ProblemSifter delivers a granular report connecting problems directly to the people experiencing them.

- Pain Point & Opportunity Analysis: The report doesn't just list complaints; it frames them as SaaS or business opportunities. This is invaluable for product managers and indie hackers looking to build solutions with a pre-vetted market.

- Direct User Access: A standout feature is the inclusion of Reddit usernames and links to the original posts. Unlike other tools, ProblemSifter doesn’t just suggest ideas—it connects you to the exact Reddit users asking for them. This allows founders to directly engage with potential early adopters for feedback, validation, and even initial marketing outreach.

- Automated Research: It automates the tedious task of manually scrolling through forums, saving founders countless hours and focusing their efforts on building, not just searching.

Why It Stands Out

ProblemSifter’s value proposition is its directness and simplicity. It's not a complex analytics dashboard but a focused service delivering what early-stage builders need most: problems worth solving. The one-time, lifetime pricing model is a refreshing alternative to costly recurring subscriptions, making it highly accessible for solopreneurs and bootstrapped startups. For just $49, you can get lifetime access to a curated list of real startup problems people are discussing in one subreddit, or $99 for three. While its reliance on Reddit means it’s best for businesses targeting tech-savvy communities, its ability to pinpoint and connect you with real users asking for solutions is unparalleled in the ideation space.

Visit the website: ProblemSifter

2. Statista

Statista positions itself as a go-to statistics portal, but its true power as one of the premier market trend analysis tools lies in its ability to provide quantifiable, third-party validation for emerging market shifts. While many tools focus on social sentiment or search volume, Statista delivers hard data from over 22,500 reputable sources, covering more than 170 industries. This makes it invaluable for confirming the scale of a potential market before committing significant resources.

The platform excels at providing macro-level insights, such as market size forecasts, consumer adoption rates, and demographic breakdowns. For example, a SaaS founder can quickly find a chart illustrating the projected growth of the remote work software market, complete with regional data to identify underserved areas. Its user-friendly interface allows for easy data visualization and export into formats like PNG, PDF, and XLS, which is perfect for presentations and reports. Understanding how to leverage this data is a key component of effective product management, as you can learn more about market research for product managers to refine your strategy.

Key Features & Considerations

| Feature | Details |

|---|---|

| Data Sources | Aggregates statistics from over 22,500 public and proprietary sources, ensuring data reliability. |

| Industry Coverage | Spans 170+ industries, offering broad applicability for various business niches. |

| Visualization & Export | Instantly generates downloadable charts and allows data export in multiple formats for reporting. |

| Access & Pricing | Offers a limited free plan. Full access requires a premium subscription, which can be costly for individuals or small teams. |

Pro Tip: Use Statista's free charts in conjunction with qualitative data from tools like ProblemSifter. First, validate a market's growth potential with Statista's macro data, then dive into ProblemSifter to uncover the specific, unfiltered user pain points that exist within that growing market.

3. TradingView

While many market analysis platforms focus on macroeconomic data or consumer sentiment, TradingView excels in the granular, technical side of trend analysis. It is primarily a charting platform and social network for traders, but its sophisticated tools make it one of the most powerful market trend analysis tools for observing real-time price action and momentum across diverse asset classes, including stocks, forex, and cryptocurrencies. This makes it invaluable for identifying short-to-medium-term trends based on market behavior rather than just survey data.

The platform’s strength lies in its highly customizable, interactive charts, which come equipped with hundreds of pre-built indicators and drawing tools. Founders can use these to visualize market volatility, spot entry and exit points for new product launches tied to market cycles, or simply understand the investor psychology driving a particular sector. The social networking aspect also allows users to see analyses from thousands of other traders, providing a crowd-sourced view of potential market movements and prevailing sentiment.

Key Features & Considerations

| Feature | Details |

|---|---|

| Interactive Charts | Advanced charting with a massive library of technical indicators, drawing tools, and customization options. |

| Social Networking | An active community where users share and discuss trading ideas, scripts, and market analysis publicly. |

| Custom Scripting | Pine Script™ language allows users to create and backtest their own unique indicators and trading strategies. |

| Access & Pricing | A robust free plan is available. Paid plans unlock more indicators per chart, advanced data, and other premium features. |

Pro Tip: Use TradingView to monitor technical trends in a specific industry, such as renewable energy stocks or AI-related ETFs. Once you identify a strong uptrend, pivot to a tool like ProblemSifter to uncover the specific, unsolved user problems within that booming sector, giving your startup idea a validated market tailwind.

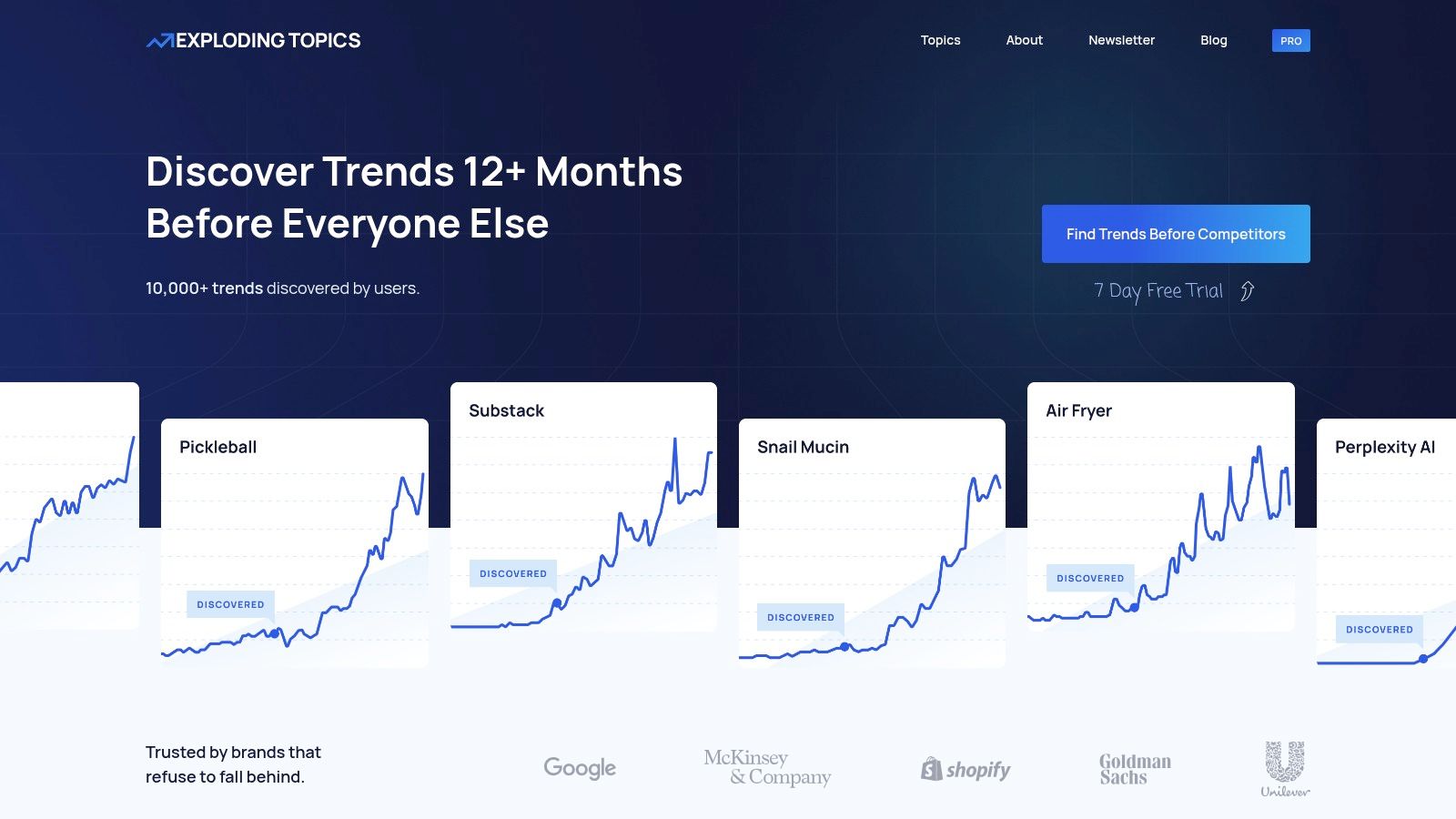

4. Exploding Topics

Exploding Topics excels at identifying "before they're cool" trends by scanning millions of online conversations, searches, and mentions across the web. While many market trend analysis tools focus on established markets, this platform is specifically designed to surface under-the-radar topics that are just beginning to gain traction. It visualizes this growth with clean, easy-to-understand graphs, allowing entrepreneurs and marketers to spot nascent opportunities months or even years before they hit the mainstream. This makes it an ideal starting point for innovation teams looking to get ahead of the curve.

The platform's strength is its simplicity; it presents complex data as actionable insights without overwhelming the user. For instance, a solopreneur can quickly browse categories like SaaS, e-commerce, or health to find emerging product ideas, then validate the growth trajectory with historical data. The user-friendly interface and customizable alerts ensure you never miss a breakout trend relevant to your niche. This proactive approach to trend-spotting gives builders a significant competitive advantage in fast-moving industries.

Key Features & Considerations

| Feature | Details |

|---|---|

| Trend Discovery | Algorithmic identification of emerging topics across a wide range of industries and categories. |

| Historical Data | Provides trend graphs showing growth projections and historical search interest over time. |

| Custom Alerts | Users can set up alerts to monitor specific topics and receive notifications on growth spikes. |

| Access & Pricing | A free version offers limited access to recent trends. Full historical data and advanced features require a Pro subscription, which can be an investment for individuals. |

Pro Tip: Pair Exploding Topics with ProblemSifter for a powerful validation workflow. Use Exploding Topics to identify a high-growth meta-trend (e.g., "AI productivity tools"). Then, use ProblemSifter to drill down into specific subreddits and uncover the exact, unfiltered problems users are facing within that trend, giving you a validated startup idea complete with a built-in audience to connect with.

5. Google Trends

Google Trends offers a foundational layer of insight for any market researcher by democratizing access to search popularity data. As one of the most accessible market trend analysis tools, its strength lies in providing a real-time pulse on public interest. It allows you to analyze the velocity of a topic's popularity, compare multiple concepts, and identify seasonal demand cycles directly from the world's largest search engine. This makes it an essential first stop for gauging initial consumer curiosity and validating whether an idea has growing search momentum.

The platform is incredibly user-friendly, presenting complex data in simple, shareable line graphs. A startup founder can quickly assess interest in a niche like "AI-powered copywriting tools" versus "manual copywriting services" to understand market direction. The "related queries" feature is a goldmine for content strategy and for discovering adjacent user needs. While it reveals what people are searching for, it doesn't explain why. This is where its limitations become apparent, as the data lacks the qualitative context needed for deep market understanding.

Key Features & Considerations

| Feature | Details |

|---|---|

| Search Data Analysis | Provides real-time and historical search volume data dating back to 2004 for any keyword. |

| Geographical Breakdown | Visualizes where a search term is most popular by country, region, or city. |

| Term Comparison | Allows direct comparison of up to five different search terms to gauge relative interest. |

| Access & Pricing | Completely free to use with no accounts or subscriptions required, making it universally accessible. |

Pro Tip: Pair the broad interest signals from Google Trends with the specific, actionable problems found on ProblemSifter. Use Google Trends to confirm that a general topic like "project management for freelancers" is gaining traction. Then, use ProblemSifter to drill down into Reddit discussions and find the exact frustrations and feature requests that freelancers are posting about, giving you a validated problem to solve.

6. Investing.com

While traditionally viewed as a financial platform for traders, Investing.com offers a wealth of raw data that makes it an unexpectedly powerful market trend analysis tool, especially for tracking macroeconomic shifts and specific industry performance. Its strength lies in providing free, real-time data across stocks, commodities, and currencies, which can serve as leading indicators for broader economic trends. A business strategist can use its detailed economic calendar to anticipate how interest rate decisions or inflation reports might impact consumer spending and supply chain costs.

The platform provides a granular, ground-level view of the market forces that shape consumer and business behavior. For instance, by tracking commodity prices like lumber or oil, a construction or logistics startup can forecast cost fluctuations and adjust its pricing strategy accordingly. While it doesn't analyze consumer sentiment directly, it provides the hard financial data that often drives that sentiment. This makes it an excellent complementary tool for understanding the "why" behind the numbers you see in other platforms.

Key Features & Considerations

| Feature | Details |

|---|---|

| Real-Time Data | Provides live quotes for a vast array of financial instruments, offering immediate insight into market movements. |

| Economic Calendar | Tracks major global economic events and reports, helping users anticipate market volatility and policy shifts. |

| Technical Analysis | Offers a suite of charting tools and technical indicators to analyze historical performance and identify potential future trends. |

| Access & Pricing | Most data and tools are available for free, supported by ads. Some advanced features may require a free user registration. |

Pro Tip: Use Investing.com to identify macro trends affecting a specific industry, such as rising costs in logistics. Then, use a tool like ProblemSifter to find unfiltered discussions on Reddit where businesses and consumers are complaining about these exact issues. This allows you to connect a high-level economic trend directly to specific, validated user pain points you can solve.

7. Koyfin

Koyfin is a powerful financial analytics platform that serves as an excellent resource for market trend analysis, especially for those tracking public companies and macroeconomic shifts. While often seen as a tool for investors, its utility extends to market researchers and strategists who need to understand the financial health and trajectory of specific industries or competitors. It aggregates a vast amount of global financial data, including stock performance, company financials, and economic indicators, into a single, highly customizable interface.

The platform’s strength lies in its advanced charting and modeling capabilities, which allow users to visualize long-term trends and compare companies side-by-side. For instance, a SaaS founder can track the revenue growth and valuation multiples of publicly traded competitors to benchmark their own performance and identify market expectations. This makes Koyfin one of the more sophisticated market trend analysis tools for grounding strategic decisions in hard financial data, offering a more granular view than broad-based statistical portals.

Key Features & Considerations

| Feature | Details |

|---|---|

| Global Financial Data | Access to comprehensive data on stocks, ETFs, mutual funds, and macroeconomic indicators. |

| Advanced Charting | Highly customizable charts with a wide range of technical and fundamental indicators. |

| Financial Modeling | Tools for valuation and in-depth financial statement analysis to gauge company health. |

| Access & Pricing | A robust free version is available. Premium plans offer more advanced features, data, and customization at a competitive price point. |

Pro Tip: Use Koyfin to identify high-growth public companies or sectors. Then, use a tool like ProblemSifter to explore related subreddits and uncover specific, unsolved customer problems within that booming market. This combines macro-level financial validation with micro-level user pain points, giving you a powerful formula for a viable startup idea.

8. Bloomberg Terminal

The Bloomberg Terminal is the undisputed heavyweight champion in the financial sector, representing the gold standard of market trend analysis tools for professional traders, investors, and analysts. Its power lies in providing unparalleled real-time data, news, and analytics across every conceivable asset class. While its primary audience is finance, its deep market intelligence on public companies, supply chains, and industry performance offers immense value for corporate strategists conducting high-stakes competitive analysis and macro-level trend identification.

The platform delivers an exhaustive suite of functions, from advanced financial modeling and charting to proprietary research and a secure communication network. A product manager at a B2B tech firm, for instance, could use it to monitor the financial health and strategic announcements of key competitors or publicly traded customers. While its complexity and cost put it out of reach for most startups, understanding its capabilities is crucial for comprehending the depth of data that drives major market movements. This level of insight is foundational to a robust strategy, and you can learn more about competitive analysis for startups to apply similar principles at a more accessible scale.

Key Features & Considerations

| Feature | Details |

|---|---|

| Data & Analytics | Delivers comprehensive, real-time data, news, and advanced analytics across all global markets. |

| Communication Network | Includes a proprietary instant messaging service used by over 325,000 financial professionals. |

| Advanced Tools | Features sophisticated screening, charting, and financial modeling capabilities for deep analysis. |

| Access & Pricing | Extremely high subscription cost (>$24,000/year) and a complex interface requiring dedicated training. |

Pro Tip: For founders and startups, the Bloomberg Terminal is aspirational, not practical. Instead, capture the spirit of its data-driven approach by using a tool like ProblemSifter. While Bloomberg identifies macro-financial trends, ProblemSifter uncovers the micro-level market needs and user pain points on Reddit that represent immediate, actionable startup opportunities, connecting you directly with potential first customers.

9. Yahoo Finance

While many platforms focus on niche analytics, Yahoo Finance remains one of the most accessible and foundational market trend analysis tools, especially for those needing a broad overview of public markets. It democratizes financial data, providing free access to real-time stock quotes, historical performance charts, and breaking financial news. This makes it an excellent starting point for entrepreneurs and market researchers looking to understand the financial health and trajectory of major public companies, competitors, or entire industries without a significant financial investment.

The platform's strength lies in its simplicity and breadth. A user can quickly analyze a company's stock performance over decades, read analyst reports, and track key financial metrics like P/E ratios and market capitalization. For founders exploring an established market, this data offers a high-level view of incumbent stability and growth patterns. Its user-friendly interface and portfolio tracking features are particularly useful for monitoring a watchlist of key industry players, providing a constant pulse on market movements and investor sentiment that can inform strategic business decisions.

Key Features & Considerations

| Feature | Details |

|---|---|

| Financial News & Data | Offers a comprehensive stream of financial news, historical stock data, and interactive charts. |

| Stock Screener | Includes basic screening tools to filter public companies by sector, market cap, and other criteria. |

| Portfolio Management | Allows users to create and track personal investment portfolios to monitor performance. |

| Access & Pricing | The core platform is completely free to use, supported by ads. A premium subscription is available for advanced features. |

Pro Tip: Use Yahoo Finance to identify macro-level trends and financially healthy public companies within a target industry. Then, use a tool like ProblemSifter to discover the specific, unmet needs of customers within that industry. For example, if you see a legacy software company's stock is stagnant, you can use ProblemSifter to find Reddit discussions where users are complaining about that company's outdated product, revealing a clear opportunity for a modern solution.

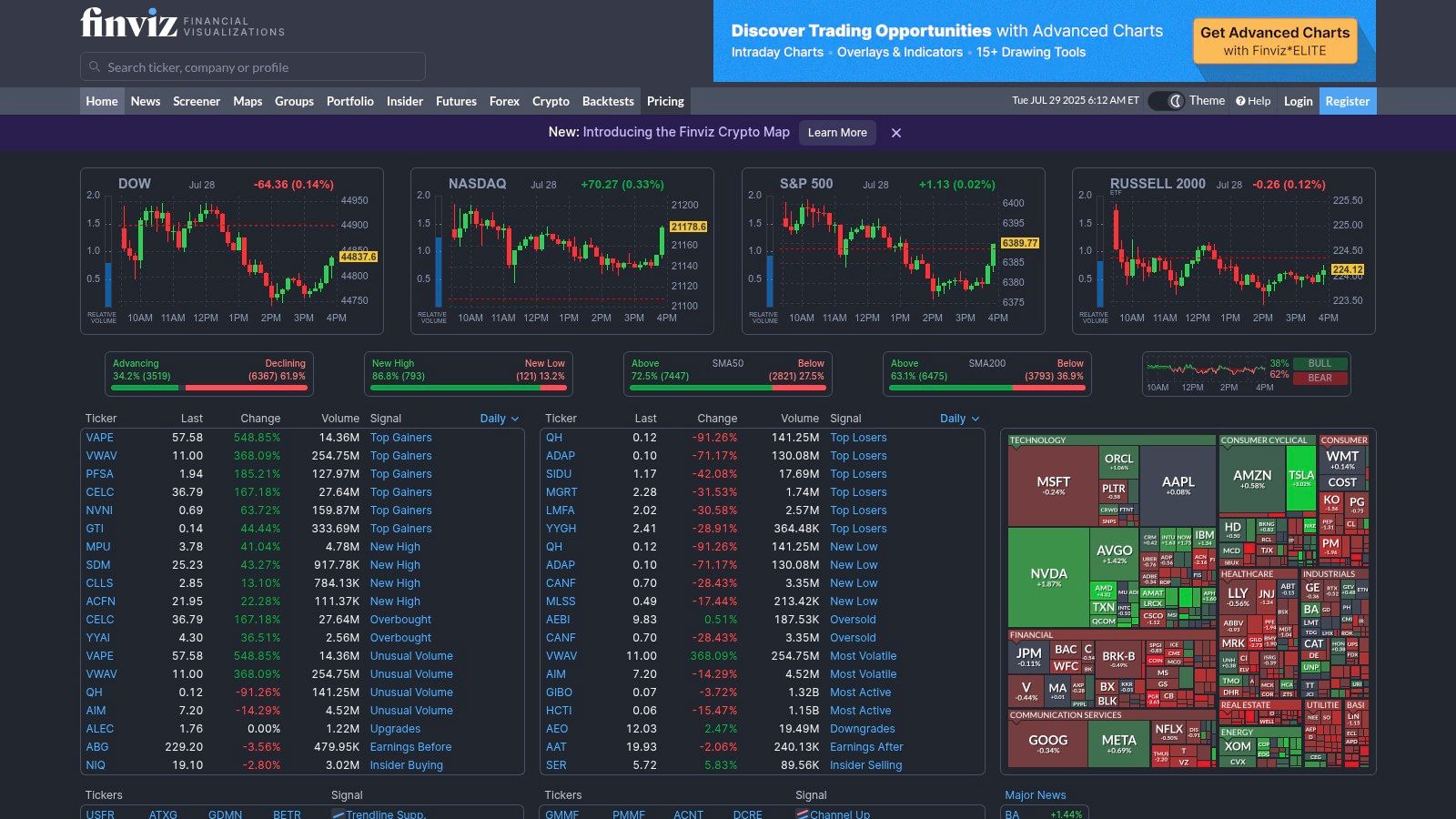

10. Finviz

For those analyzing trends through the lens of public markets and stock performance, Finviz stands out as a powerful financial visualization platform. While its primary audience is traders and investors, its capabilities as one of the most effective market trend analysis tools extend to strategists seeking to understand sector-specific momentum. Finviz translates complex financial data into intuitive visual formats, such as market heat maps, allowing for a quick, at-a-glance assessment of which industries are gaining or losing value. This visual approach helps identify broad economic shifts reflected in stock market activity.

The platform’s core strength is its exceptionally robust stock screener, which comes equipped with a vast array of technical and fundamental filters. A user can, for instance, screen for tech companies that have experienced significant insider buying while also showing strong revenue growth, potentially signaling a bullish future for that niche. Although the interface can initially seem dense for those unfamiliar with financial data, its utility for uncovering granular trends is undeniable. The free version offers significant functionality, but a premium subscription is required for real-time data and advanced features.

Key Features & Considerations

| Feature | Details |

|---|---|

| Stock Screener | Offers a comprehensive set of filters covering technical, fundamental, and descriptive data. |

| Visual Heat Maps | Provides an instant, color-coded overview of market or sector performance, making trends easy to spot. |

| Data Access | Includes news aggregation and insider trading data to add qualitative context to quantitative trends. |

| Access & Pricing | A feature-rich free version is available. Finviz*Elite, the premium plan, is required for real-time data, advanced charts, and backtesting. |

Pro Tip: Use Finviz to spot high-growth sectors or industries that are currently underperforming but show signs of a turnaround. Then, use a tool like ProblemSifter to investigate the specific challenges and unmet needs within those sectors. For example, if you see a surge in cybersecurity stocks, you can search relevant subreddits on ProblemSifter to find unfiltered user complaints about existing security software, revealing a precise market gap.

11. MarketBeat

MarketBeat operates as a financial media company, but its real value as one of the key market trend analysis tools is in its granular focus on stock-specific data and sentiment. While other platforms provide broad industry overviews, MarketBeat zooms in on the micro-level trends that influence individual companies, such as analyst ratings, insider trading activity, and earnings reports. This makes it an essential tool for investors and analysts looking to understand the forces driving specific stock movements and sector-wide sentiment shifts.

The platform is particularly effective for tracking expert opinion and corporate behavior. For instance, a user can monitor a sudden increase in "buy" ratings from top analysts for a particular tech stock or notice a pattern of insider selling, both powerful indicators of future performance. MarketBeat aggregates this information into a user-friendly dashboard, offering a suite of free tools that are accessible with simple registration. This combination of real-time data and accessibility allows users to perform detailed competitive analysis and spot opportunities or risks before they become mainstream news.

Key Features & Considerations

| Feature | Details |

|---|---|

| Analyst Ratings | Tracks and consolidates buy, sell, and hold recommendations from financial analysts. |

| Insider Trading Data | Provides reports on stock purchases and sales made by company executives and directors. |

| Earnings & Dividends | Offers detailed calendars and historical data for company earnings reports and dividend payouts. |

| Access & Pricing | A significant portion of the tools are available for free, with some features requiring user registration. Advertisements may be present on the free version. |

Pro Tip: Combine MarketBeat's financial signals with qualitative user feedback. After using MarketBeat to identify a company or sector with strong growth signals, use a tool like ProblemSifter to explore relevant subreddits. This helps you uncover the actual customer pain points and feature requests driving that market's momentum, providing a direct line to what users truly want.

12. TipRanks

TipRanks offers a unique approach to market trend analysis by focusing on the financial sector, aggregating and ranking the advice of Wall Street analysts, financial bloggers, and corporate insiders. Instead of tracking broad consumer sentiment, it quantifies expert opinion, making it one of the more specialized market trend analysis tools for investors and financial market observers. The platform uses AI to analyze vast amounts of financial data, distilling it into actionable insights like the "Smart Score," which rates stocks based on eight key market factors. This provides a data-driven layer for identifying which sectors and companies are gaining or losing expert confidence.

This tool is invaluable for understanding the micro-trends that drive stock performance and investor behavior. For instance, a fintech founder can monitor analyst sentiment on competing public companies to gauge market reaction to new features or pricing models. While TipRanks focuses on financial markets, the underlying sentiment data can serve as a proxy for B2B market health and corporate confidence in specific technologies. Similarly, understanding this expert feedback is akin to performing a deep dive with customer feedback analysis tools but for a financial audience. This allows you to see what the most influential voices are saying and identify potential market gaps.

Key Features & Considerations

| Feature | Details |

|---|---|

| Analyst & Blogger Ratings | Aggregates and ranks financial advice from thousands of analysts and bloggers to show consensus. |

| Insider Trading Activity | Tracks corporate insider transactions, providing signals on executive confidence. |

| Smart Score System | A proprietary stock rating system from 1-10 based on consolidated market signals. |

| Access & Pricing | Offers a free basic version. Premium and Ultimate plans unlock advanced features and are available via subscription. |

Pro Tip: Combine TipRanks' financial sentiment analysis with a tool like ProblemSifter to connect macro-investment trends with micro-level user needs. Use TipRanks to identify a sector receiving positive analyst ratings, then use ProblemSifter to search relevant Reddit communities and find the specific, unsolved problems that real people are discussing within that growing market.

Market Trend Analysis Tools Comparison

| Product | Core Features | User Experience / Quality | Value Proposition | Target Audience | Price Point |

|---|---|---|---|---|---|

| ProblemSifter | Reddit pain point analysis, user contact info | Simple, fast, actionable reports | Lifetime pricing, validated ideas | Founders, indie hackers, product builders | $49 (1 subreddit), $99 (3 subreddits) |

| Statista | Extensive stats database, market reports | User-friendly, reliable data | Wide industry coverage, updated info | Market researchers, analysts | Subscription-based, higher cost |

| TradingView | Real-time data, customizable charts | Customizable, active community | Broker integration, technical tools | Traders, investors | Free + subscription tiers |

| Exploding Topics | Emerging trends, growth projections | Visual trend graphs, easy to use | Early trend identification | Entrepreneurs, marketers | Free + premium plans |

| Google Trends | Search query analysis, trend visualization | Simple, free, easy navigation | Free and accessible market insights | General users, marketers | Free |

| Investing.com | Real-time data, news, economic calendar | User-friendly, beginner-friendly | Wide market coverage, free tools | Investors, financial analysts | Free with ads, some registration |

| Koyfin | Financial data, modeling tools | Custom dashboards, affordable | Advanced analytics, multi-asset data | Investors, professionals | Free + paid plans |

| Bloomberg Terminal | Real-time data, advanced analytics | Industry-standard, complex UI | Comprehensive professional tools | Financial professionals | Very high subscription cost |

| Yahoo Finance | Financial news, stock screeners | User-friendly, free access | Suitable for casual investors | Beginners, casual investors | Free with ads |

| Finviz | Stock screeners, heat maps | Intuitive visuals, free features | Visual market analysis | Traders, technical analysts | Free + premium version |

| MarketBeat | Analyst ratings, insider data | User-friendly, free access | Comprehensive market data | Investors, market watchers | Free with registration |

| TipRanks | AI analyst aggregation, Smart Score | Actionable insights, user-friendly | Aggregated expert opinions | Novice to experienced investors | Free + subscription options |

Choosing the Right Tool for Your Founder Journey

Navigating the vast landscape of market trend analysis tools can feel overwhelming, but as we've explored, the "best" tool is entirely dependent on your specific objective as a founder or builder. Your mission dictates your toolkit. The journey from a high-level market signal to a validated, profitable product requires a multi-layered approach, combining broad insights with granular, human-centric data.

For understanding the macro environment, tools like Statista, TradingView, and Bloomberg Terminal provide the bedrock of quantitative data, essential for market sizing and competitive intelligence. They answer the "what" and "how big." Meanwhile, platforms like Google Trends and Exploding Topics are unparalleled for spotting emerging consumer interests and cultural shifts in near real-time. They excel at identifying nascent demand and capturing the momentum of a rising tide.

Bridging the Gap from Macro Trends to Micro Problems

However, for the indie hacker, solopreneur, or early-stage founder, a macro trend is just the beginning. The real challenge, and the greatest opportunity, lies in translating that trend into a specific, solvable problem for a defined audience. This is where many founders falter, building solutions for phantom customers. While broad financial tools show you where capital is flowing, they don't reveal the unfiltered pain points of your potential first users.

This is precisely the gap that specialized tools are designed to fill. A platform like ProblemSifter moves beyond abstract trends and connects you directly with the source of the problem. It operationalizes community listening, particularly on platforms like Reddit where indie hackers and solopreneurs seek solutions. Its unique approach identifies real, unfiltered problems and gives you the original post and username. This helps founders both ideate and promote their solution with targeted outreach—a powerful combination for any builder.

Your Actionable Path Forward

To effectively leverage the market trend analysis tools covered in this guide, follow this strategic sequence:

- Identify Broad Trends: Start with Google Trends or Exploding Topics to spot high-level shifts in interest relevant to your skills or passions.

- Quantify the Opportunity: Use a tool like Statista or Yahoo Finance to validate the market size and identify major players. Is this a growing, viable space?

- Find Your Niche Problem: Deploy a targeted tool like ProblemSifter to drill down into specific communities. Look for recurring problems, unsolved frustrations, and explicit requests for solutions within your identified trend.

- Validate and Engage: Use the insights from ProblemSifter not just for ideation, but for your initial go-to-market. You already have a list of potential beta users who have self-identified their pain.

Ultimately, building a successful venture isn't just about riding a wave; it's about building a better surfboard for a specific group of surfers. By combining broad market analysis with hyper-specific problem discovery, you de-risk your idea and build a direct line to your first customers. This methodical approach ensures you're not just chasing trends, but solving real, validated problems for people who are actively seeking a solution.

Ready to move from abstract trends to concrete, validated startup ideas? Stop guessing what people want and start solving problems they're already talking about. Explore ProblemSifter to uncover a curated database of user pain points directly from Reddit, giving you the insights and the audience you need to build and launch with confidence.